Services

Accurate, Timely, and Personalized Tax Preparation You Can Always Rely On

We do more than just prepare taxes at D&H Tax Prep LLC. We provide financial security, support, and confidence to individuals and businesses.

Individual Tax Returns (Form 1040)

Filing your taxes can feel overwhelming, but it does not have to be. Whether you are a first-time filer, a working professional, a retiree, or self-employed, our goal is to make the process simple and stress-free.

Partnership Returns (Form 1065)

Running a partnership means juggling responsibilities, and taxes can be one of the most complex parts. We handle Form 1065 partnership returns with precision, ensuring every income allocation, deduction, and credit is correctly reported. Each partner’s K-1 form is prepared with care and accuracy so everyone’s tax position is properly represented.

S corporate Tax Returns (Form 1120 S)

Corporations face unique tax challenges that demand expert attention. At D&H Tax Prep LLC, we provide comprehensive corporate tax preparation for businesses of all sizes. We ensure full compliance with federal and state requirements while also looking for opportunities to minimize tax burdens and support future growth.

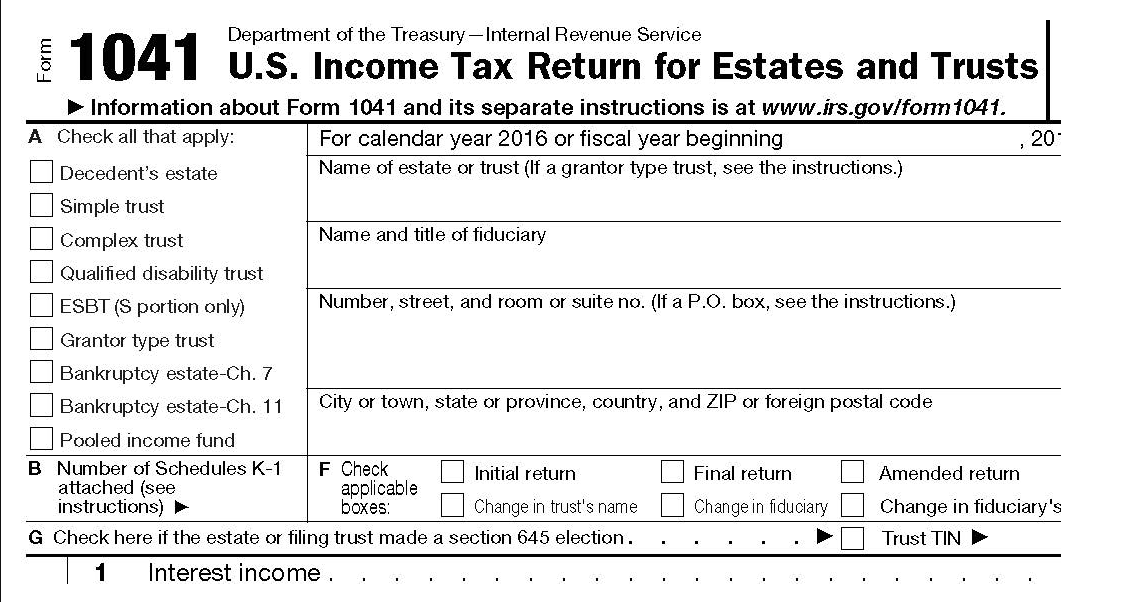

Estate Returns (Form 1041)

Dealing with estate and trust taxes requires both technical knowledge and sensitivity. We understand the emotional and financial importance of these matters and handle estate and trust returns with great care.

IRS Inquiries and Audit Support

Receiving a notice from the IRS can cause anxiety, but you do not have to face it alone. We have extensive experience working with IRS inquiries, audits, and tax notices, helping clients resolve issues efficiently and confidently.

State Tax Inquiries and Compliance

Every state has its own set of tax rules, and keeping track of them can be challenging. Whether you received a state tax notice or need to correct previous filings, we can help.

Tax Planning Services

Smart tax planning can make a big difference throughout the year, not just at filing time. Our tax planning services help individuals, families, and businesses make informed financial decisions that reduce taxes and increase savings.